401k Catch Up Contribution Limits 2025 Over 50. The limit on annual contributions to an ira increased to $7,000, up from $6,500. You can contribute more to your 401 (k) beginning at age 50.

For 2025, the 401 (k) annual contribution limit is $23,000, up from $22,500 in 2025. The limit on annual contributions to an ira increased to $7,000, up from $6,500.

401(k) Contribution Limits in 2025 Meld Financial, Retirement savers are eligible to put $500 more in a 401. You can contribute more to your 401 (k) beginning at age 50.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, The ira catch‑up contribution limit for individuals aged 50 and over was amended under the secure 2.0 act of 2025 (secure 2.0) to include an annual cost‑of‑living. This increase reflects a continued trend.

401(k) Contribution Limits for 2025, 2025, and Prior Years, For 2025, contribute up to $23,000 to a 401(k) and $7,000 to an ira; Retirement savers are eligible to put $500 more in a 401.

The Maximum 401(k) Contribution Limit For 2025, A traditional contribution refers to. The employee contributions are the same as the annual limits for a traditional 401(k) plan.

IRA Contribution Limits in 2025 & 2025 Contributions & Age Limits, For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2025. The limit for overall contributions—including the employer match—is 100% of.

The IRS just announced the 2025 401(k) and IRA contribution limits, This amount is an increase of. You can contribute more to your 401 (k) beginning at age 50.

2025 Ira Contribution Limits Over 50 EE2022, This amount is an increase of. The employee contributions are the same as the annual limits for a traditional 401(k) plan.

Solo 401k Contribution Limits for 2025 and 2025, Employer matching contributions do not count toward the $23,000 401 (k) contribution limit in 2025. Employees age 50 and older are subject to a higher contribution limit with either type of contribution.

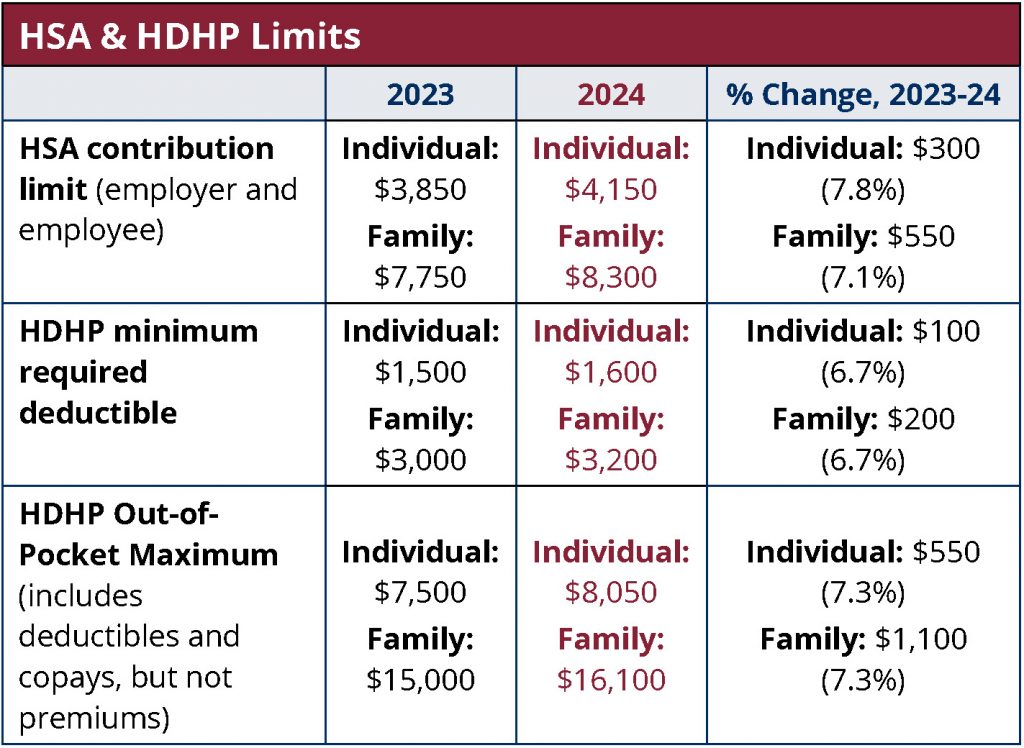

2025 HSA Contribution Limit Jumps Nearly 8 MedBen, Employees age 50 and older are subject to a higher contribution limit with either type of contribution. This amount is an increase of.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, A traditional contribution refers to. Plan participants in these plans may wish to consider the impact of the dollar.

For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2025.